tax strategies for high income earners australia

Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income earners on this list. So what are the top tax planning strategies for high income employees.

5 Tax Deductions For High Earners Plus A Tax Hack The Physician Philosopher

A donor-advised fund DAF is an investment account created to.

. Its possible that you could. Set up a discretionary trust. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super.

An easy way to avoid paying this for high-income earners is by acquiring private health insurance hospital cover making it an easy way to reduce tax. As a refresher for 2021 FY the individual tax rates including medicare levy are. Division 293 tax is an extra charge imposed on some of the super.

Health Savings Account HSA Contributing to an HSA is a great tax planning strategy because they offer three tax advantages. For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19. Appropriate types and amounts of insurance cover.

Contribute to your Superannuation. However the tax benefits. Business owners hire your kids.

Given that most are employed in. This is an important strategy for residents of high-income tax states with significant investment income. The contributions are tax deductible.

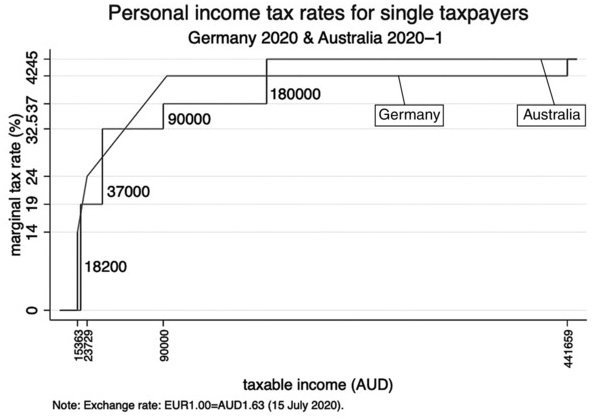

If you are over age 50 you can contribute an additional 6500 per year in catch-up contributions meaning you. Another tax planning strategy for individuals that. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to.

How to Reduce Taxable Income. For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19. As a refresher for 2021 fy the.

August 12 2014. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. Superannuation contribution options to reduce taxes.

As a refresher for 2021 fy the. Tax Reduction Strategies For High Income Earners Australia. For 2022 the maximum employee deferral to 401 k is 20500.

Qualified charitable distributions qcd 4. Australians earning over 27k pay the Medicare Levy calculated at 2 of an individuals taxable income. High income earners singles earning 90k and couples with a joint income of.

A range of both basic and advanced tax strategies and investment options can be explored to this end. 6 Tax Strategies for High Net Worth Individuals 1.

Tax Reduction Strategies For High Income Earners 2022

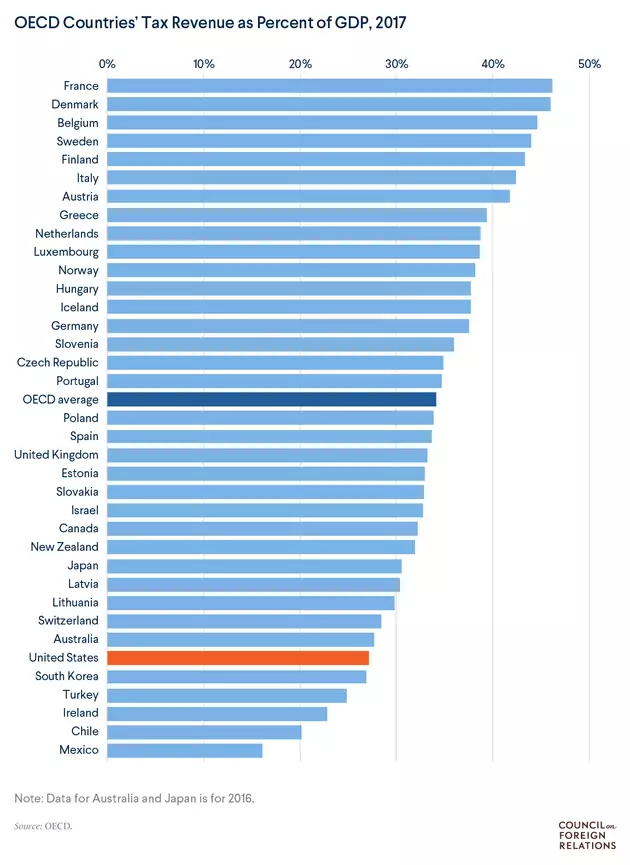

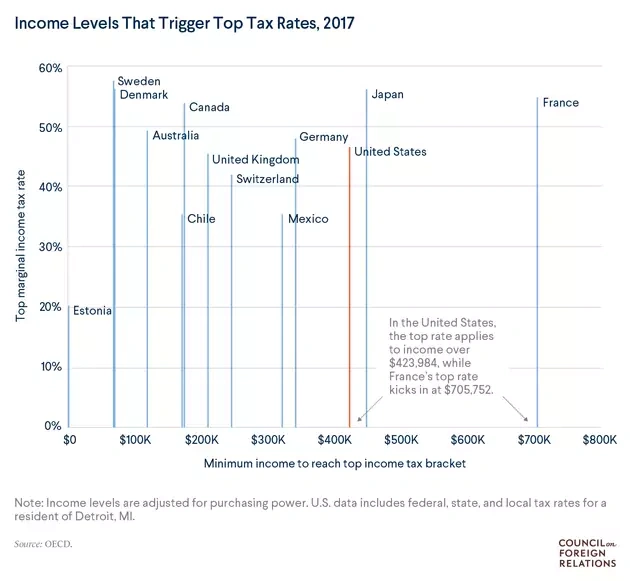

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Calling All Retiring Types Make Sure Your Superannuation Fund Stays Super South China Morning Post

High Earners This Secret Roth Ira Strategy Could Make You Wealthy The Motley Fool

Australia Briefing Tax Cut Pressure Qantas Macquarie Italian Deal Bloomberg

Propublica Many Of The Uber Rich Pay Next To No Income Tax Ap News

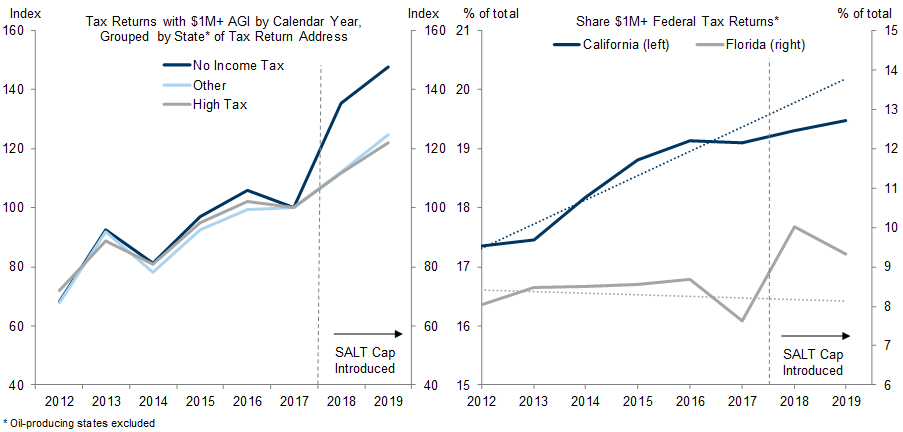

No Taxation Without Emigration Briggs

Tax Strategies For High Income Earners 2022 Youtube

Tax Minimisation Strategies For High Income Earners

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Arizona Voters Approve Massive Tax Hike On High Earners Could Your State Be Next

2021 Capital Gains Tax Rates In Europe Tax Foundation

The Super Rich And Tax Lifters Or Leaners

Backdoor Roth Conversion For High Income Earners Is It Right For You

The Australia Institute 2019 Budget Wrap By The Australia Institute Medium

Australia Briefing Tax Cut Pressure Qantas Macquarie Italian Deal Bloomberg

Tax Law In Context Part Ii Tax And Government In The 21st Century